car lease tax benefit

They create fierce price competition and prevent manufacturer monopolies. Please contact us to learn more and to get the best car lease deal today.

Is Your Car Lease A Tax Write Off A Guide For Freelancers

When an employer talks about your salary they mean your basic starting salary.

. The payments interest tax upkeep and maintenance of a car leased through a company are all tax deductible. New Jerseys neighborhood new car and truck dealers represent the economic engine on Main Street. Feel free to take your time when browsing our through our line of automobiles.

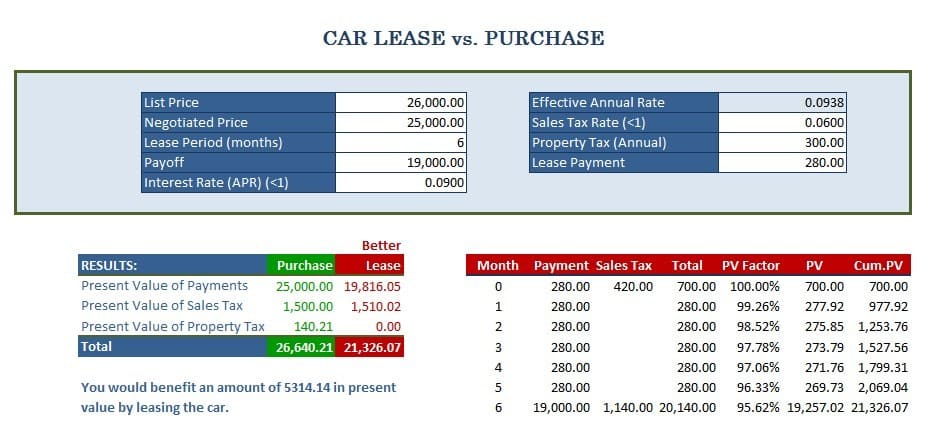

The computation of tax implications will be as follows. You can claim back up to 50 of the tax on the monthly payments of your lease up to 100 of the tax on a. As previously mentioned business leasing can provide considerable tax benefits.

In India there is no. As well as the Plug in Car Grant of 3000 for cars costing up to 50000 and the 350 grant towards home. Ad All-round carefree FINN car subscription.

A benefit in kind is a workplace benefit that can be used in your personal time as well as during working hours. Visit Section 3 Fringe Benefit Valuation Rules for the valuation rules on vehicle use. Our services are also available in New Jersey Connecticut and Pennsylvania.

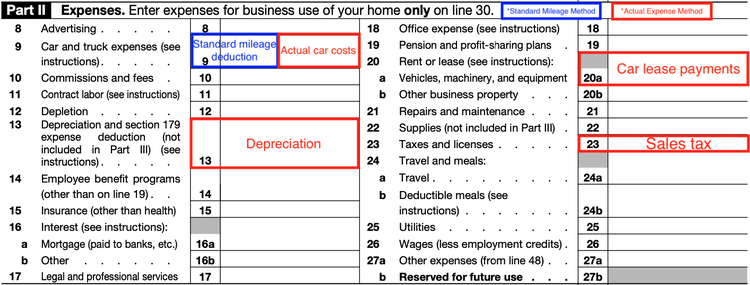

Create Print Your Free Vehicle Rental Agreement in Under 5 Minutes. Answer 1 of 3. You can deduct the business portion of your lease payments and other car expenses.

In most parts of the US when you lease a vehicle you dont pay sales tax on the whole value of a leased vehicle but instead you are only taxed on the portion. This is applicable for self-employed as well. Employers can offer incentives such as.

Various components are then added to this number to create your final salary package. The buy option at the end of lease is also available abroad but it is an option. Ad For car shoppers who want the latest cars leasing is a good fit.

We have a team of experts that are. What documents will you ask me to provide. This is a massive incentive to switch and the tax relief may not be around forever.

Everything included except fuel. Leasing a vehicle could help you save as much as 30 on your taxes. Business car leasing is a great way to minimise costs and ensure youre carrying as little financial baggage as possible.

There are various tax benefits too. Unlike in USA and elsewhere car lease in India is actually a hire-purchase scheme. Discover the benefits of leasing a car and pitfalls to avoid when navigating the process.

The value of benefit derived from an existing car with renewed COE is computed as follows. We even allow our clients to submit their auto lease application online. In general the fair market value of an employer-provided vehicle is the amount the employee would have.

Tax Benefits. Van benefit-in-kind BIK tax commonly referred to as Company Van Tax or Van Benefit Charge is the taxation applied for an employees personal van use. We never hassle or.

It really is that simple. Monthly fixed price with no down payment and hidden fees. Leasing a car can have tax benefits.

If your business is. 37 x GDE 045 per km x private mileage if employee pays for the cost of petrol. Ad Answer a Few Simple Questions to Create Your Vehicle Leasing Agreement.

On the other hand make sure you know the downsides of car leasing. First and foremost we will want to see. You can call us at 516-780-0679 for a free consultation or use the Case Evaluation Form on our web site.

What are the tax benefits of leasing a car through your business. The lease amount you pay for a vehicle is eligible for tax relief. If you use your leased vehicle for business purposes you can generally directly deduct the costs as business expenses monthly payments insurance mileage maintenance.

Deduct a amount of Rs 2400 from the above figure for a car above 16 litres OR a amount of Rs 1800 for a car below 16 litres. Short terms Free door-to-door delivery.

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Is It Better To Buy Or Lease A Car Taxact Blog

How Is Car Lease Tax Benefit Calculated In India For Individual Salaried Employee Who Uses The Car For Both Official And Personal Purpose Can You Explain With An Example Quora

Is Your Car Lease A Tax Write Off A Guide For Freelancers

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

Is It Better To Buy Or Lease A Car Taxact Blog

Is Your Car Lease A Tax Write Off A Guide For Freelancers

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

How To Take A Tax Deduction For The Business Use Of Your Car

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

How Does Leasing A Car Work Earnest

How To Write Off A Car Lease For Your Business In 2022

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense